procter and gamble health share price forecast

Procter Gamble Health Ltd. Detailed news announcements financial report company information annual report balance sheet profit loss account results and more.

Procter Gamble Stock Good For Dividend Growth Nasdaq

Detailed news announcements financial report company information annual report balance sheet profit loss account results and more.

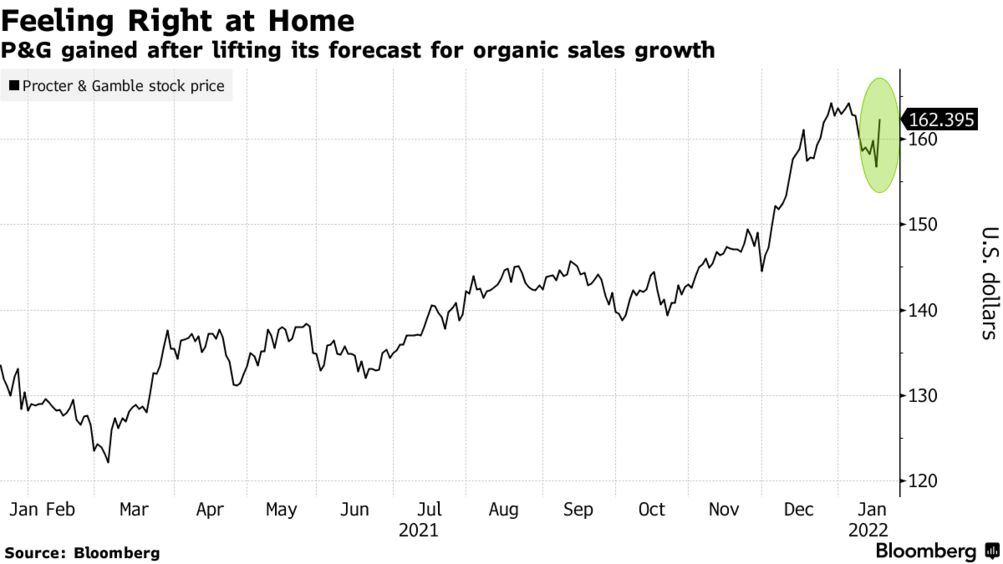

. The next dividend is forecast to go ex-div in 12 days and is expected to be paid in 1 month. 1 shares for every 2 shares held Rights Jun 14 1991 Jul 12 1991 Mar 30 1991 Rights ratio. April 20 Reuters Procter Gamble Co raised its full-year sales forecast on Wednesday as consumer demand for cleaning and personal care products remained stronger than expected despite higher prices sending its shares up more than 2.

1 shares for every 2 shares held Bonus Nov 19 1997-Sep 24 1997 Bonus Ratio. Key ProductsRevenue Segments include Pharmaceutical Products Other Operating Revenue Duty Drawback and. Check the payment calculator for the amount.

Shares of Procter Gamble stock opened at 14230 on Friday. The company has a debt-to-equity ratio of 053 a quick ratio of 047 and a current ratio of 068. Procter Gamble Health Ltd incorporated in the year 1967 is a Mid Cap company having a market cap of Rs 709267 Crore operating in Pharmaceuticals sector.

1 share for every 10 held at a price of Rs 650 Bonus--Aug 22 1989. PG dividend was 9133c and was paid 2 months ago. The firm has a market capitalization of 34142 billion a price-to-earnings ratio of.

The dividend yield is calculated by dividing the annual dividend payment by the prevailing share price. The Procter Gamble Company has a 52 week low of 12950. The previous Procter Gamble Co.

Get Procter and Gamble Hygiene and Health Care Ltd. Get Procter Gamble Health Ltd. PG stock opened at 14435 on Monday.

The Global Advanced Shopping Technology market is anticipated to rise at a considerable rate during the forecast period between 2022 and 2028. Bonus Dec 10 2003 Dec 11 2003 Sep 08 2003 Bonus Ratio. Wal-Mart Procter and Gamble.

Over the last 30 days the Zacks Consensus Estimate has changed -05. PG is expected to post earnings of 124 per share for the current quarter representing a year-over-year change of 97. Recasts adds commentary from analyst call By Jessica DiNapoli and Uday Sampath Kumar.

P G Plans To Raise Prices For Tide And Other Brands

Unilever Share Price Punched As Empire Building Worries Remain

Medical Cannabis Market Forecast To 2028 Covid 19 Impact And Global Analysis By Product Type Medical Application And Geography

Procter Gamble Hygiene And Health Care Limited Price Pghh Forecast With Price Charts

Skincare Products Market 47 Of Growth To Originate From Apac By Product Face Skincare Products And Body Skincare Products Distribution Channel And Geography Market Size Share Trends Analysis And Segment Forecasts 2020 2024

Procter Gamble A Long Term Winner Nasdaq

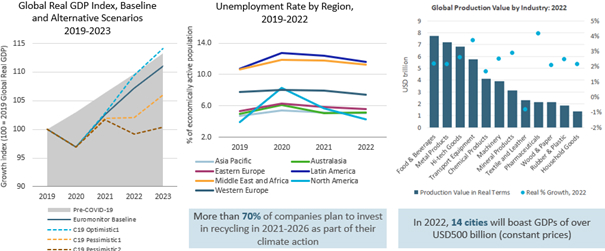

Global Economic Outlook October 2020 Euromonitor Com

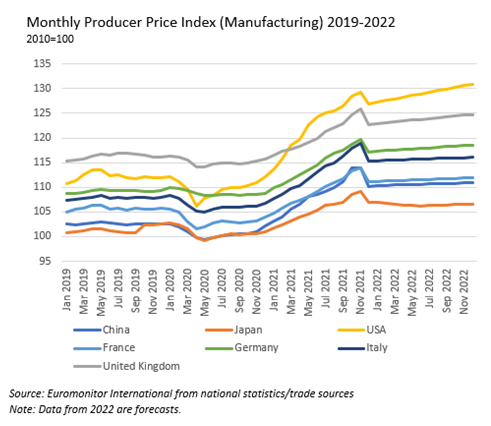

Key Trends To Watch In Economies In 2022 Euromonitor Com

P G Pg Raises Sales Outlook As Inflation Boosts Tide Downy Bloomberg

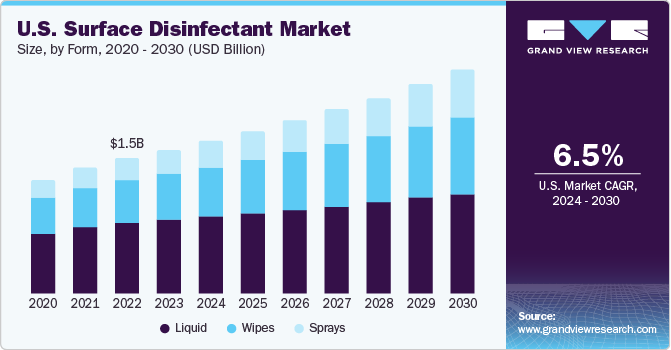

Surface Disinfectant Market Size Share Report 2030

Business This Week The Economist

Procter Gamble Pg Q3 2022 Earnings

Procter Gamble Hygiene And Health Care Limited Price Pghh Forecast With Price Charts

Unilever Share Price Is Cheap But Is It A Value Trap

Three Main Risks Facing Businesses In 2022 Omicron Supply Chain And Inflation Euromonitor Com

Procter Gamble Share Price Prediction Target For Tomorrow More

Procter Gamble Raises Sales Forecast As Demand Stays Price Resistant